What can you claim?

Please find below what you can include in your R&D tax relief claim.

Staff costs including salaries and expenses.

Subcontractor and freelancer costs.

Consumables (materials used up during R&D and utilities).

Software directly employed in the R&D activity.

Travel and subsistence expenses.

Learn moreSectors

We have helped businesses across a range of sectors claim R&D tax credits for their innovative work.

Our Claim Process

Assessment

Analysis

Report & Sign Off

CT600 Submitted

Funds Received

Discover your potential claim value today

Use our handy R&D tax relief calculator to find out how much you could be claiming back.

R&D CalculatorIn April 2022 we were delighted that the Business Growth Fund (BGF) invested in the BSE group to facilitate rapid growth over the coming years. This move led to the redevelopment of our management structure, the recruitment of more specialist staff, as well as the expansion into additional offices across the UK.

Mark Joyner

Director

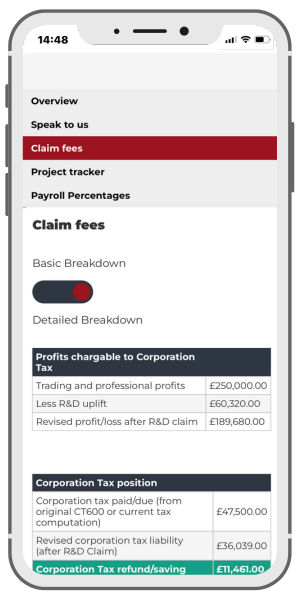

Quick & Simple Communication

Increased and easier communication - one click contact integrating voice messaging, SMS and email.

24/7 Access

Custom developed and fully mobile responsive, allowing you to access anytime and on any device.

Complete Claim Visibility

Instant control and tracking of your current and historical R&D claims, and their live status.

Claim & Fee Transparency

Plan more accurately by knowing the benefit you will receive and RDS fee due on successful claim.

Case Studies

At RDS we have helped over 1000 companies successfully claim. Below is just a sample of some recent R&D tax credit claims we have completed.

Frequently asked questions

Below are some of the most frequently asked questions we get regarding making an R&D tax relief claim. If you have any more questions please contact our team.

R&D tax credits is an incentive where UK limited companies can receive a reduction or rebate on their CT for funds spent on eligible R&D activities. This incentive was established by the government in 2000 and has continued to support businesses of all sizes and sectors to grow.

No, you do not need to create a new product to qualify for R&D tax credits. For instance, you can make significant advancement or appreciable improvement to existing machinery, in a manner that promotes efficiencies within your sector.

Yes, you can claim for unsuccessful projects if you can demonstrate that an advancement was sought, and you attempted to overcome the ‘uncertainties’ you faced during your research and development endeavours.

No, we do not bill you until you receive your benefit from HMRC. The relationship we build with our clients is based on the principles of trust and transparency. Therefore, the benefit is paid directly to you before you pay us for the services rendered.

For many firms, the prospect of R&D can seem daunting and extremely complex at first, therefore RDS aim to make the process as simple and straightforward from the onset.

Step 1: A 15-minute conversation with the Business Development Team, to discuss eligibility.

Step 2: Signing of the NDA/ client agreement, dictating the terms and conditions of our service.

Step 3: Arranging and undertaking a Project Technical Report call with your dedicated financial analyst. This will entail evidencing your developmental endeavours and apportioning financial calculations to support your application with HMRC.

Step 4: Reviewing compiled information to ensure you are completely satisfied with the information collated prior to its submission to HMRC.

Step 5: We actively monitor the status of the application to ensure that any benefit is realised within the anticipated timeframe.

HMRC aim to process payable credit claims within 28 days of receiving them. However, processing time can be affected by aspects such as, time of the year. There is a general increase in demand for months like March and December.

Ready to get started?

With three UK office locations we are always on hand for a call or to meet in person. Start your journey with RDS today.